Keep knowledgeable with free updates

Merely signal as much as the UK inflation myFT Digest — delivered on to your inbox.

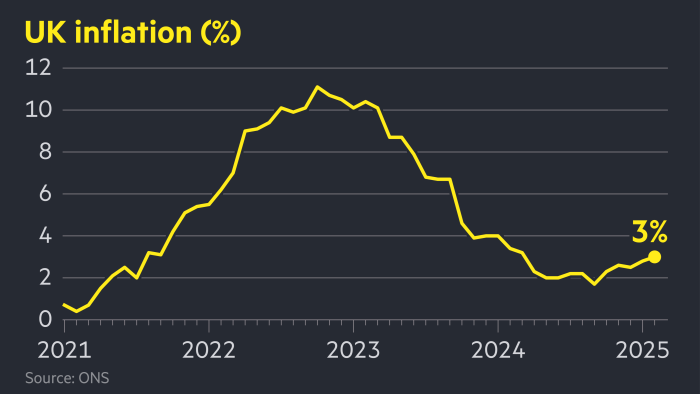

UK inflation rose greater than anticipated to a 10-month excessive of three per cent in January, highlighting the problem for the Financial institution of England because it contends with persistent value pressures and a weakened financial system.

The annual price of value progress was above the two.5 per cent recorded in December and the two.8 per cent forecast by economists polled by Reuters, the Workplace for Nationwide Statistics stated on Wednesday. It was additionally effectively above the latest low of 1.7 per cent in September.

The rise was pushed by airfares dropping lower than is common in January, larger prices for personal faculties after the federal government imposed VAT on charges and elevated prices for meals and non-alcoholic drinks, the ONS stated.

Providers inflation, a key measure of underlying value pressures for rate-setters, rose to five per cent in January, up from 4.4 per cent in December, however was under the BoE’s expectations of 5.2 per cent. Core inflation, which excludes power, meals, alcohol and tobacco, climbed to three.7 per cent from 3.2 per cent in December, in keeping with analysts’ expectations.

Ruth Gregory, an economist on the consultancy Capital Economics, stated that concern on the BoE could be tempered by the function of airfares in January’s rise and the smaller than anticipated enhance in providers inflation.

“We doubt this [inflation data] will stop the Financial institution of England from chopping rates of interest additional, however it can imply it continues to chop charges solely slowly,” she stated.

The BoE stated this month that value pressures had been on “a bumpy path” because it forecast inflation would rise to three.7 per cent in the midst of the 12 months, propelled by larger world power prices. The central financial institution stated it anticipated inflation to later fall again to round its 2 per cent goal.

UK wage progress excluding bonuses rose to an annual price of 5.9 per cent within the three months to December, figures printed on Tuesday confirmed. However financial progress has been weak, with official information final week displaying a marginal growth of 0.1 per cent within the three months to December, following the stagnation of the earlier quarter.

BoE governor Andrew Bailey on Tuesday stated the central financial institution had been capable of lower rates of interest 3 times since final summer season due to easing inflation, which hit a 41-year excessive of 11.1 per cent in October 2022, and since “we face a weak progress surroundings within the UK”.

He additionally reiterated the BoE’s intention to take a “gradual and cautious” method to rate of interest cuts, including {that a} doubtless additional rise in inflation this 12 months was among the many “challenges” dealing with the central financial institution.

Following Wednesday’s figures, merchants continued to wager that the BoE would ship two additional quarter-point cuts in charges this 12 months after decreasing borrowing prices this month, however scaled again the prospect of the primary transfer coming in March to fifteen per cent from 25 per cent.

The yield on the rate-sensitive two-year gilt rose 0.04 proportion factors to 4.28 per cent. The pound was down 0.3 per cent by late afternoon towards a broadly stronger greenback at $1.257.

Zara Nokes, world market analyst at JPMorgan Asset Administration, stated that this week’s information would trigger the BoE “fairly a headache” and officers ought to put “better weight on the upside inflation dangers versus any reasonable cooling in financial exercise”.

In line with ONS information, the annual inflation price within the training sector rose to 7.5 per cent in January from 5 per cent in December, reflecting a 12.7 per cent enhance in the price of non-public faculties after the federal government levied VAT on charges.

Meals and non-alcoholic beverage costs rose 3.3 per cent in January, up from 2 per cent in December.

Responding to Wednesday’s figures, chancellor Rachel Reeves stated: “For the reason that election, we’ve seen year-on-year wages after inflation rising at their quickest price in three years — value an additional £1,000 a 12 months on common — however I do know that tens of millions of households are nonetheless struggling to make ends meet.”

The rebound in inflation is a blow to Reeves, who has been criticised by companies for October’s tax-raising Finances, with polls suggesting she is dropping the arrogance of the general public.

An Ipsos survey this month discovered that 46 per cent of voters thought she was doing a foul job as chancellor with solely 16 per cent optimistic, giving her the worst internet ranking since Labour took workplace in July.

Mel Stride, shadow chancellor, stated: “In the present day’s inflation figures imply additional ache for household funds — and it’s because of the Labour chancellor’s report tax hikes and inflation-busting pay rises.”

With further reporting by George Parker in London

This text has been amended since publication after the Treasury corrected Rachel Reeves’ assertion