Lagos, Nigeria — Mandela Fadahunsi, who works at a technical coaching college in Ikeja in Nigeria’s Lagos, by no means believed he may fall sufferer to a Ponzi scheme.

On April 6, the 26-year-old was beginning his day when a WhatsApp notification lit up his telephone display. Somebody on the group chat for buyers of the cryptocurrency funding platform, Crypto Bridge Change (CBEX), had tried and did not withdraw some funds, in order that they wished to substantiate if it was a basic situation. Fadahunsi rapidly logged on to his digital pockets and tried to withdraw 500 USDT, a cryptocurrency that stands for United States Greenback Tether, or just Tether.

However 24 hours later, a course of that ought to have taken simply 10 minutes was but to finish. He knew then that one thing had gone flawed. He began to panic, however half-hoped it was only a glitch or a minor system error.

“They [CBEX administrators] stated it was because of the extreme quantity of individuals attempting to withdraw, and that each one withdrawals have been positioned on maintain till fifteenth of April,” Fadahunsi informed Al Jazeera.

On the fifteenth, he and fellow buyers waited however heard nothing. On subsequent days, the directors gave extra excuses till the positioning stopped working altogether, and everybody’s cash disappeared with out a hint. That’s when he realised he had been scammed and would possibly by no means be capable to get well the 4,596 USDT stablecoin in his pockets.

Whereas Fadahunsi tallied his losses, the difficulty went viral on social media platforms.

Many extra Nigerians shared their tales of loss, whereas others mocked them for shedding their cash to scammers. Some members of the general public, stuffed with rage, attacked and ransacked CBEX places of work in Ibadan and Lagos.

CBEX launched operations in Nigeria in July 2024, claiming to have the ability to generate immense buying and selling earnings utilizing generative synthetic intelligence. By January, it had gained critical reputation by means of referrals and sensible promoting.

Fadahunsi and hundreds of different individuals invested with the hope of constructing a most revenue – the scheme promised as much as one hundred pc return on funding after a 40- to 45-day maturation interval. Initially, the scheme did pay out, and the testimonies of profitable preliminary buyers attracted extra individuals to enroll.

However after 9 months of operation, the music stopped because the platform made away with an estimated 1.3 trillion naira ($840m), based on the official Nigerian Monetary Intelligence Unit (NFIU). It left buyers surprised.

Nigeria’s anticorruption company, the Financial and Monetary Crimes Fee (EFCC), has since labelled CBEX a Ponzi scheme. Consultants say the organisers of such scams normally promise to speculate individuals’s cash in one thing that generates excessive returns, however in actuality, it’s funding fraud that pays present buyers with funds collected from new ones. As soon as numerous individuals money out, and new buyers into the scheme dry up, it collapses.

Ponzi schemes, together with CBEX, are normally not backed by any discernible financial exercise, consultants say. In keeping with Ikemesit Effiong, from the Lagos-based socioeconomic advisory agency, SBM Intelligence, most occasions these companies should not have something to promote and haven’t any recognisable enterprise fashions. Even the agriculture-based ones declare to have merchandise that investigators are unable to trace. In addition they largely depend on present buyers to usher in new buyers who function their downlink within the pyramid scheme.

Consultants say that in Nigeria, widespread monetary illiteracy, lax laws, greed, financial hardship and peer strain make buyers inclined to the machinations of Ponzi organisations that mix aggressive promoting, word-of-mouth campaigns charged by incentives, and preliminary excessive returns.

However on the finish, the schemes depart victims – lots of whom make investments their financial savings, enterprise capital, and borrowed cash – unable to do something however watch their hard-earned cash disappear.

‘Make some positive factors’

Fadahunsi first heard in regards to the CBEX scheme from colleagues initially of the 12 months. Initially, he was hesitant. However a number of days later, his neighbour additionally talked about the platform. Recognising that his shut associates have been taking part, and never desirous to miss out, he determined to speculate.

“I additionally thought the cash was simply sitting in my account, and it could possibly be someplace the place I could make some positive factors on my cash,” he defined.

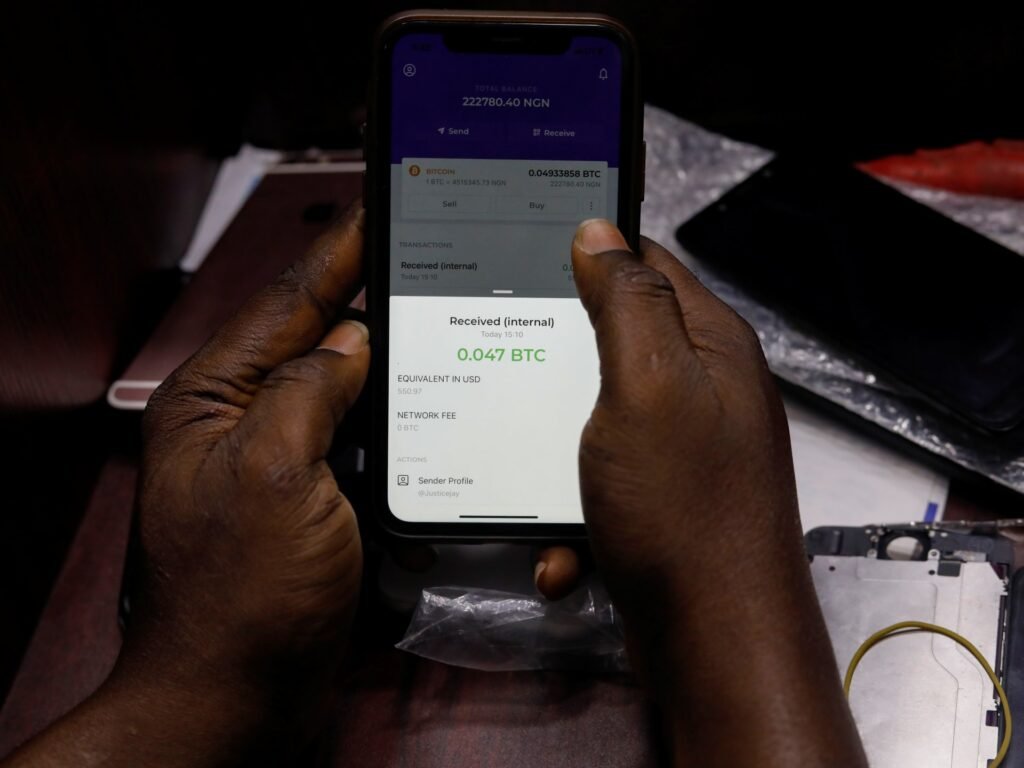

In early February, he dipped into his hire financial savings and withdrew your complete 800,000 naira ($517). With that, he purchased 500 USDT from the crypto change platform Buybit, receiving the coin in his digital CBEX pockets.

4 occasions a day on the CBEX platform, directors dropped a code, which they name a “sign”. Traders have been required to repeat and paste the code into a piece of their portal throughout the hour. CBEX stated AI would then use that to make a commerce, principally to purchase and promote or change positions in such a means that it made a revenue from worth fluctuations on the buyers’ behalf. Every time Fadahunsi pasted within the code, he would get 4.7 to five USDT as a revenue, all of which accrued in direction of his returns.

“So the extra you do it, the extra the share will increase. In a month, I bought double of 500 USDT,” he stated, including that there have been additionally bonuses for issues like referrals.

In March, customers stated CBEX made an adjustment the place they not enter the sign. As a substitute, buyers simply needed to activate an “AI internet hosting” choice initially of the day. However some buyers say this was doubtless only a ploy to maintain them going, to persuade them they have been nonetheless making a revenue at the beginning crashed in April.

Whereas some buyers withdrew their returns, by the point CBEX crashed, Fadahunsi had not withdrawn any cash. He had wished to maximise the funding alternative, to go away the funds to develop for 5 to 6 months earlier than utilizing them to purchase a plot of land to construct his future dwelling. Now, that dream is lifeless.

“It is extremely onerous, however thank God that my landlord is definitely understanding,” he stated.

“I’m not happy with opening my mouth [to say] that I truly invested in a Ponzi scheme,” he lamented. “If I wasn’t grasping, I ought to have been capable of withdraw two to a few occasions on the platform, and it will have been profitable.”

A historical past of Ponzi schemes

Even earlier than CBEX, Ponzi schemes weren’t new in Nigeria.

In March, Nigeria’s anticorruption company printed a list of 58 Ponzi schemes presently working within the nation, and suggested the general public to “be vigilant and proactive”. This highlights the widespread presence of fraudulent entities masquerading as authentic companies within the nation: in 23 years, Nigerians misplaced 911 billion naira ($589m) to Ponzi-related scams, the Nationwide Deposit Insurance coverage Company (NDIC), which protects the nation’s banking system, stated in 2022.

Usually, Ponzi schemes are capable of function by leveraging gray areas, reminiscent of acquiring an irrelevant certification that exaggerates their significance or legitimacy.

CBEX, as an illustration, obtained the EFCC’s anti-money laundering certificates by means of the company id of ST Applied sciences Worldwide Ltd, and paraded it as a sort of clearance for conducting enterprise.

Nonetheless, the NFIU stated CBEX was by no means granted a registration by the Securities and Change Fee (SEC) to function as a Digital Belongings Change, solicit investments from the general public or carry out some other perform throughout the Nigerian capital market.

Legit companies may be verified by checking the SEC web site. Nonetheless, consultants say the overwhelming majority of those that put money into shady schemes appear unaware or uneducated about this – 38 p.c of Nigerians are financially illiterate, based on a 2023 central financial institution report.

On the similar time, different victims could also be prepared members, a minimum of at first.

Joachim MacEbong, a senior analyst at Stears, a Lagos-based monetary advisory agency, stated whereas some victims are unwitting, others deliberately stroll into Ponzi schemes hoping to make a fast revenue earlier than it crashes.

“There are those that know it’s a rip-off, however they all the time really feel they might money out earlier than everyone else. And they also would make that calculation, and it’s largely due to the scenario within the nation; there’s a number of hardship. This sort of hardship will increase the individuals’s want to take dangers and gamble with their essential funds,” he defined.

Nigeria’s economic system has been on a downward spiral for many years, and is worse now that the nation goes by means of its hardest financial downturn in about 30 years. Meals costs have soared, and fundamental facilities have gotten inaccessible because the inflation charge sits at 23.71 p.c. Towards this backdrop, some see Ponzi schemes as a quick method to get away of the vicious cycle of poverty.

Just like the proverbial early hen, early buyers benefitted from the CBEX scheme, multiplying their returns for a number of months. Though social media is agog with complaints and bitter disappointment, some individuals stated that they had been capable of make main purchases reminiscent of land and vehicles from their funding.

“The time scale at which you enter the funding will decide whether or not will probably be a superb funding or you may be a sufferer,” stated Effiong of SBM Intelligence, however he added that many new buyers are unaware of this catch.

‘We had a number of plans’

Waris Oyedele is without doubt one of the individuals who invested their financial savings in CBEX due to worsening monetary hardship within the nation.

When he realised that the funding had crashed, he wept.

The 25-year-old comes from a low-income household. He graduated from Obafemi Awolowo College final 12 months, however when he couldn’t get a job, he began working as a shoemaker.

In January, he invested his financial savings of 800,000 naira (500 USDT); by March he had made 1,200 USDT.

He gave the returns to his youthful brother to reinvest to assist him pay for his future college research, and in doing so, assist ease their father’s monetary burden.

“I felt unhealthy [when we lost the money] as a result of we had a number of plans on it,” Oyedele stated.

“I had a plan of shopping for a pc and going into UI/UX. Now it has gone.”

He’s deeply affected by the scenario and has decreased the way in which he spends his tiny earnings as he tries to rebuild his financial savings for future use and to help his brother.

Ponzi schemes play on psychology and human instincts by making it appear as if straightforward cash is inside attain, Effiong of SBM stated.

All investments contain some type of greed, Effiong defined, and the promise of ending up with a better return is without doubt one of the most basic types of human motivation: all of us need extra and as rapidly as potential.

“What [a Ponzi scheme] does is that it additionally unlocks the deep-seated psychological bend for human beings to affix teams – the plain concern of lacking out,” he stated. “It additionally thrives on actually aggressive advertising – all of that’s to prey on the psychology of potential buyers to not decelerate.”

Agile ways

Over time, Ponzi schemes have employed a number of methods to enchantment to individuals, even going the additional mile to attempt to construct public belief and goodwill. CBEX, for instance, organised a sports activities competitors and ran scholarships for schoolchildren to throw off suspicion, consultants stated.

In Nigeria, schemes rely closely on present buyers who’re incentivised to introduce new buyers. In addition they have interaction in aggressive advertising utilizing native and social media, typically involving radio, influencers and movie star endorsements. Afrobeats stars Davido and Rema are a few of the hottest celebrities to have unknowingly endorsed and made promo movies for Ponzi schemes up to now.

Ponzi schemes are additionally changing into more and more refined and dynamic as they leverage the most recent applied sciences and digital instruments, consultants say.

“Lots of them have apps with fantastic consumer experiences, which lend an air of credibility to their enterprise. Many of those scammers go to nice lengths to design their merchandise in such a means that they give the impression of being and seem credible,” Effiong stated.

MacEbong from Stears agreed, saying pretend information and misinformation campaigns will turn out to be supercharged utilizing AI instruments, making it simpler to hoodwink unsuspecting victims.

“There are quite a few examples of generative AI getting used to idiot people who find themselves even properly knowledgeable and extra savvy. Once you flip these numerous instruments towards individuals with a lot decrease publicity and data, they’re virtually defenceless,” MacEbong defined.

Regulators such because the SEC should turn out to be extra proactive and provide you with agile ways to rein in Ponzi schemes and shield the general public from illegitimate enterprises and shut them down earlier than they trigger hurt, consultants informed Al Jazeera.

Companies have to be registered and completely vetted as a result of Ponzi schemes have been erroneously licensed up to now, Effiong emphasised.

“There must be a number of monetary schooling. Monetary literacy is crucial, which works past generate profits, however [also] to coach the general public on the tell-tale indicators of Ponzi schemes. The duty additionally lies with most people to coach themselves. If it sounds too good to be true, chances are high it’s too good to be true,” he stated.

On Could 26, EFCC stated it had recovered a portion of the cash stolen by CBEX and arrested two people selling it. Al Jazeera tried to contact CBEX for remark by means of its web site and publicly obtainable telephone numbers, however all have been unavailable or out of service.

In the meantime, many buyers like Fadahunsi have misplaced hope and consider that the cash they invested is all gone.

“In any way the authorities retrieve, I’m positive that nothing goes to come back to me; I moved on already,” he stated. “That could be a very robust lesson for me. [Now,] I’d moderately hold my cash in my account and spend it until the final dime.”