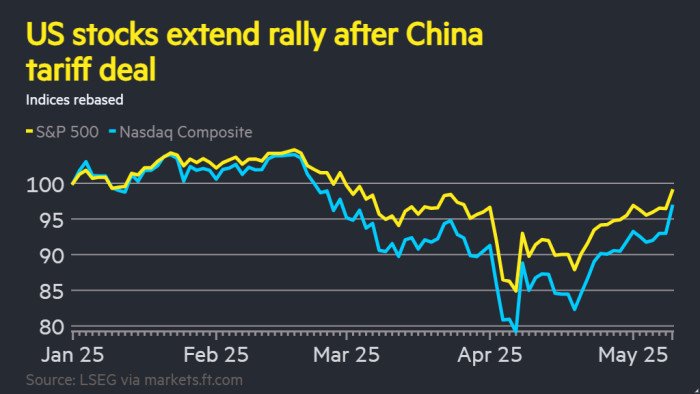

Investor sentiment was exuberant on Monday morning as US shares soared and Treasury yields rose after the US and China agreed to slash tariffs.

“Markets are defaulting to assuming we’re now in a 10-30 world: 10 per cent (tariffs) on many of the world, 30 per cent on China. Peak tariffs are very a lot up to now. We’ll take a development hit this yr, however that’s completely different from a recession,” mentioned Ajay Rajadhyaksha, world chair of analysis at Barclays.

The shift over the weekend signifies that the Federal Reserve might maintain off on rate of interest will increase till September, pricing within the futures market indicated. Even when a recession in 2025 is averted, tariffs pose an inflationary risk.

“The Fed appears genius proper now as a result of they didn’t rush to chop charges,” mentioned Rajadhyaksha.

Nonetheless, tariffs within the 10-30 per cent vary mark a radical change from no US tariffs, the state of the world when Trump was elected president.

“We’re in a considerably worse place when it comes to development on the finish of 2025, versus the top of 2024,” mentioned Rajadhyaksha. And the volatility and uncertainty across the launch of the tariffs means “there’s some near-term harm that has been achieved to US belongings. It stays to be seen if that may persist.”