The author is professor of economics at Harvard College and writer of ‘Our Greenback, Your Downside’

US fiscal coverage is operating off the rails, and there appears to be little political will in both celebration to repair it till a significant disaster happens.

The 2024 price range deficit was a mind-blowing 6.4 per cent of GDP; credible forecasts recommend that the deficit will exceed 7 per cent of GDP for the remainder of President Donald Trump’s time period. And that’s assuming there isn’t any black swan occasion that after once more causes progress to crater and debt to balloon. With US debt already exceeding 120 per cent of GDP, it appears a price range disaster of some type is extra possible than not over the following 5 years.

True, if markets trusted US politicians to prioritise totally repaying bond holders — home and overseas — above all else, and to not have interaction in partial default by way of inflation, there can be nothing to fret about.

Sadly, if one seems on the lengthy historical past of debt and inflation crises, the overwhelming majority happen in conditions the place the federal government may pay if it felt prefer it. Sometimes, a disaster is catalysed by a significant shock that catches policymakers on their again foot, when debt is already very excessive, and financial coverage rigid.

Definitely the One Massive Lovely Invoice Act preserves the tax cuts from Trump’s first time period, which in all chance helped spur progress. Nonetheless, the proof from a number of rounds of tax cuts going again to Ronald Reagan within the Eighties means that they don’t almost pay for themselves. Certainly they’ve been the main contributor to the regular run-up in debt through the twenty first century. And Trump’s new tax invoice accommodates a raft of extremely distortionary add-ons — no tax on suggestions, extra time or social safety — that aren’t useful. Not surprisingly, the Congressional Price range Workplace concluded that the invoice would add $2.4tn to debt over the following decade.

The true drawback for politicians is that American voters have turn into conditioned to by no means having to cope with sacrifice. And why ought to they?

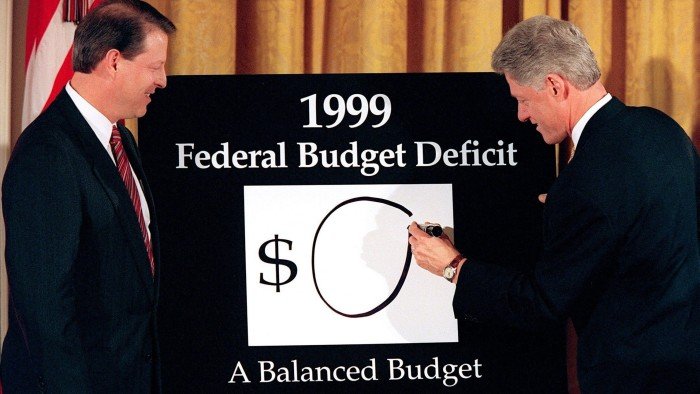

Since Invoice Clinton final balanced the price range on the finish of the Nineteen Nineties, each Republican and Democratic leaders have tripped over themselves to run ever bigger deficits, seemingly with out consequence. And if there’s a recession, monetary disaster or pandemic, voters rely on getting the most effective restoration that cash should buy. Who cares about one other 20 to 30 per cent of GDP in debt?

What has modified, sadly, is that long-term actual rates of interest right this moment are far increased than they had been within the 2010s. Between 2012 and 2021, the inflation-indexed 10-year US Treasury bond yield averaged round zero. In the present day, it’s over 2 per cent and, going ahead, curiosity funds are more likely to be an ever-larger power pushing up the US debt-to-GDP ratio. Actual curiosity rises are way more painful right this moment than they had been 20 years in the past, when US debt to GDP was half what it’s now.

Why are actual charges rising? One motive, in fact, is report international debt ranges, each private and non-private. That is solely a part of the story, nevertheless, and never essentially crucial half.

Different elements — together with geopolitical tensions, the fracturing of worldwide commerce, rising navy expenditures, the potential energy wants of AI and populism — are all vital. Sure, inequality and demographics arguably push the opposite means, which is why numerous outstanding students nonetheless consider a sustained return to ultra-low actual rates of interest will finally save the day. However ought to the US, which goals to be international hegemon for one more century or extra, be betting the farm on this?

Certainly, though long-term rates of interest could fall, it’s equally doable they might rise with the US 10-year fee, now round 4.5 per cent, ultimately reaching 6 per cent or extra. The rise shall be exacerbated if Trump succeeds in attaining his dream of a decrease US present account deficit, the flip facet being much less overseas cash coming into the US.

It’ll even be exacerbated if, as I argue in my latest book, US greenback dominance is now fraying on the edges as China continues decoupling from the greenback, Europe remilitarises and cryptocurrencies take market share within the huge international underground financial system.

Trump’s tariff wars, threats to tax overseas funding and efforts to undermine the rule of legislation will solely speed up the method. Certainly, if he succeeds in attaining his dream of closing up the US present account deficit, the lowered influx of overseas capital will push US rates of interest up additional, and progress can even undergo.

Simply because the US debt trajectory is unsustainable doesn’t imply it wants to finish dramatically. In any case, as a substitute of permitting rates of interest to proceed drifting up, the federal government can invoke growth-stifling Japanese-style monetary repression, preserving rates of interest artificially low and thereby changing any disaster right into a slow-motion crash.

However gradual progress is hardly a fascinating consequence, both. Inflation is the extra possible situation given the centrality of finance to US progress, with the federal government (whether or not Trump or a successor) discovering a strategy to undermine the independence of the Federal Reserve. The US’s excessive debt and rigid political equilibrium shall be a significant amplifier of the following disaster and, in most eventualities, the American financial system and the greenback’s international standing would be the losers.