Keep knowledgeable with free updates

Merely signal as much as the UK inflation myFT Digest — delivered on to your inbox.

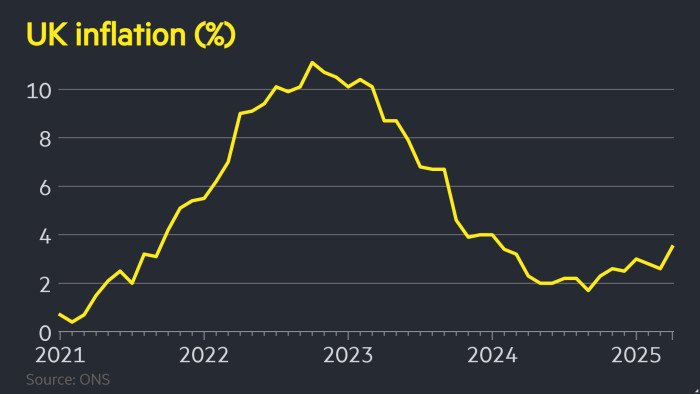

UK inflation rose greater than anticipated to a 15-month excessive of three.5 per cent in April after larger utility payments and tax rises kicked in, prompting merchants to cost in only one rate of interest minimize over the subsequent yr.

Wednesday’s determine from the Workplace for Nationwide Statistics was each larger than the three.3 per cent predicted by analysts polled by Reuters and March’s 2.6 per cent.

The rise was pushed by larger vitality prices after regulators raised the family value cap, in addition to jumps in water payments and street tax, the ONS stated. Increased airfares additionally contributed.

Providers inflation, a key measure of underlying value pressures for rate-setters, climbed to five.4 per cent in April, eclipsing the 4.8 per cent anticipated by analysts and March’s determine of 4.7 per cent.

Suren Thiru, economics director at accountants’ physique the ICAEW, stated final month’s enhance “highlights the brutal hit to family and enterprise funds from April’s multitude of eye-watering invoice rises and tax hikes”. James Smith, an economist at ING, stated the numbers put “the ultimate nail within the coffin of a Financial institution of England price minimize in June”.

Merchants trimmed their bets again to totally pricing in only one quarter-point price minimize by this time subsequent yr, in contrast with two earlier than the info, in accordance with ranges implied by swaps markets. The pound climbed to its highest degree in opposition to the greenback since early 2022 at $1.347. It later fell again to $1.344.

The Labour authorities’s enhance in employer nationwide insurance coverage contributions can be stoking costs, analysts stated. Stuart Morrison, analysis supervisor on the British Chambers of Commerce, stated corporations have been dealing with a “excellent storm of value pressures” together with nationwide insurance coverage, a minimal wage rise and world tariffs.

The UK’s CPI inflation price was properly above readings in Germany and France, in addition to the EU degree.

The BoE has vowed to stick with a “cautious and gradual” strategy to further price cuts after decreasing borrowing prices 4 instances since August.

However the Financial Coverage Committee was cut up over this month’s choice to cut rates by a quarter-point to their lowest degree since 2023. On Tuesday, chief economist Huw Pill said he feared the BoE was lowering charges too quickly and that the momentum behind falling inflation was “stuttering”.

The numbers got here as a setback to chancellor Rachel Reeves, who has been making an attempt to capitalise on stronger-than-expected first-quarter development figures in addition to a trio of commerce offers.

Reacting to the inflation numbers, Reeves stated she was “disillusioned” and acknowledged that “value of dwelling pressures are nonetheless weighing down on working folks”.

She added: “We’re a great distance from the double digit inflation we noticed below the earlier administration, however I’m decided that we go additional and quicker to place more cash in folks’s pockets.”

The BoE has predicted that inflation will attain 3.7 per cent later this yr earlier than falling again to its goal of two per cent in 2027. However analysts warned that the April knowledge confirmed indicators of upper than anticipated inflation in some elements of the economic system. Core inflation, which excludes vitality and meals, was forward of forecasts at 3.8 per cent, whereas companies inflation was properly forward of the BoE’s personal forecast, printed this month.

Air fares jumped sharply partially as a result of April’s value assortment dates coincided with the Easter holidays, analysts stated, not like in 2024.

The query for the BoE can be whether or not they decide a hefty share of April’s acceleration was pushed by erratic or one-off elements, or whether or not there are indicators that underlying inflation stays too sizzling. One space of concern is fast wage development, with annual development in common weekly wages working at 5.6 per cent, excluding bonuses, within the three months to March.

“Though a lot of the rise in inflation in April might be put right down to larger utility payments, airfares, and a hike in street tax, the large image stays that underlying inflation is just too robust for the BoE to realize its 2 per cent inflation goal,” stated Andrew Wishart at Berenberg financial institution.

Two-year authorities bond yields, that are delicate to adjustments in rate of interest expectations, rose 0.04 proportion factors to 4.09 per cent in late-morning buying and selling.

“Households are paying the worth for the Labour chancellor’s decisions,” stated Mel Stride, shadow chancellor. “Increased inflation might additionally imply rates of interest keep larger for longer, hitting household funds onerous.”