Faisal IslamEconomics editor

BBC

BBCGoogle’s ultra-private CEO Sundar Pichai is displaying me round Googleplex, its California headquarters. A walkway runs alongside the size of it, passing by a large dinosaur skeleton, a seaside volleyball pitch and dozens of Googlers lunching beneath the hazy November solar.

But it surely’s a laboratory, hidden away behind the campus behind some timber, that he’s most excited for me to see.

That is the place the invention that Google believes is its secret weapon is being developed.

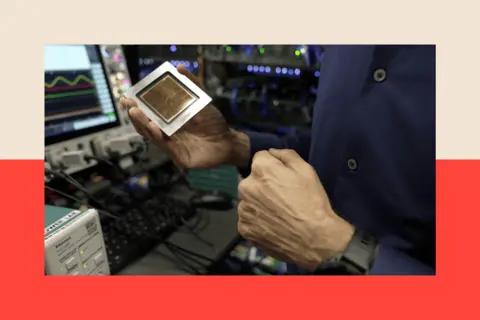

Referred to as a Tensor Processing Unit (or TPU), it appears to be like like an unassuming little chip however, says Mr Pichai, it would in the future energy each AI question that goes by way of Google. This makes it doubtlessly one of the vital vital objects on this planet financial system proper now.

“AI is probably the most profound expertise humanity [has ever worked] on,” he insists. “It has potential for extraordinary advantages – we must work by way of societal disruptions.”

However the complicated query lingering over the AI hype is whether or not it’s a bubble liable to bursting – as, if that’s the case, it could be a spectacular burst akin to the dotcom crash in the beginning of the century, with penalties for us all.

Bloomberg through Getty Photographs

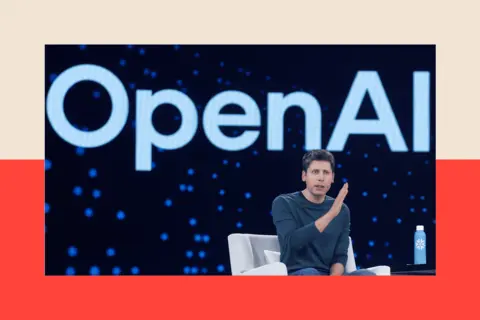

Bloomberg through Getty PhotographsThe Financial institution of England has already warned of a “sudden correction” in international monetary markets, saying “market valuations seem stretched” for tech AI companies. In the meantime. OpenAI boss Sam Altman has speculated that “there are various elements of AI that I believe are sort of bubbly proper now”.

Requested whether or not Google would be immune from a possible bubble burst, Mr Pichai mentioned it may climate that potential storm – however for all his starry-eyed pleasure across the prospects of AI, he additionally issued a warning: “I believe no firm goes to be immune, together with us.”

So why, then, is Google investing greater than $90bn a yr within the AI build-out, a three-fold improve in simply 4 years, on the very second these solutions are being mentioned?

The large AI surge – and the large danger

The AI surge – of which Google is only one half – is, in money phrases, the largest market increase the world has seen.

Its numbers are extraordinary – there’s $15 trillion of market worth at Google and 4 different tech giants whose headquarters are all inside a brief drive of each other.

Chipmaker turned AI methods pioneer Nvidia in Santa Clara is now price greater than $5 trillion. A ten-minute drive south, in Cupertino, is Apple HQ, hovering round $4 trillion; whereas quarter-hour west is $1.9 trillion Meta (beforehand Fb). And within the centre of San Francisco, OpenAI was lately valued at $500bn.

The purely monetary penalties of this development are important sufficient.

The worth of the shares in these firms (and some others exterior Silicon Valley, resembling Microsoft in Seattle) have helped cushion the US financial system from the influence of commerce wars, and stored retirement plans and investments buoyant – and never simply within the US.

But it comes with a giant danger. That’s, the unbelievable dependence of US inventory market development on the efficiency of a handful of tech giants. The Magnificent 7 – Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia, and Tesla – collectively comprise one third of the valuation of America’s whole S&P 500.

And that market worth is now extra extremely concentrated in just a few companies than it was throughout the dotcom bubble in 1999, based on the IMF.

Mr Pichai factors out that each decade or so come these “inflection factors”: the private laptop, then the web within the late Nineties, adopted by cellular and cloud. “Now it is clearly the period of Synthetic Intelligence.”

However as for the large query – is it a bubble?

Mr Pichai argues there are two methods of serious about it. First, there’s “palpably thrilling” progress of providers that individuals and firms are utilizing.

However he concedes: “It is also true once we undergo these funding cycles, there are moments we overshoot collectively as an business…

“So I believe it is each rational and there are components of irrationality by way of a second like this.”

Now, a distinction is rising within the markets between these companies that depend on typically borrowed cash and difficult offers to entry the chips that energy their AI, and the largest tech firms, resembling Google, Microsoft and Amazon, which may fund funding in chips and knowledge from their very own pockets.

Which brings us to Google’s personal silicon chips, or their prized TPUs.

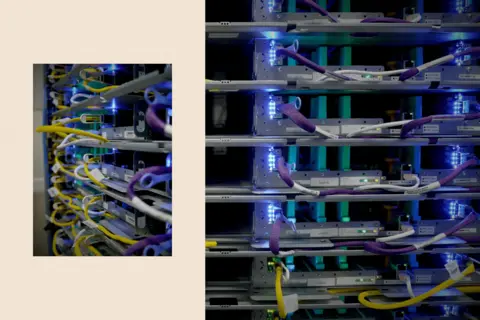

‘Restricted’: contained in the silicon chip lab

The lab, the place they’re examined, is the dimensions of a five-a-side soccer pitch with a mesh of multi-coloured wires and deep blue blinking lights. Indicators throughout learn: “restricted”.

What’s putting is the sheer noise – that is all the way down to the cooling methods, that are wanted to assist management the temperature of the chips, which may get extremely scorching when crunching trillions of calculations.

The TPUs are designed to assist energy AI machines. And so they work in another way from different forms of chips.

The CPU (central processing unit) is the first part of a pc – primarily its mind – that performs a lot of the processing and management features, whereas GPUs (graphics processing items) carry out extra specialised processing, executing many parallel duties directly – this could embody AI.

Nevertheless Asics (application-specific built-in circuits), are chips custom-built for a selected goal, for instance, a selected AI algorithm. And the TPU is a specialist Google-designed sort of Asic.

A core facet of the AI increase has been the mad sprint to amass plenty of top-performing chips and put them into knowledge centres (or the bodily amenities that retailer, course of and run giant quantities of knowledge and software program).

Nvidia’s boss Jensen Huang as soon as coined the time period “AI factories” to explain the large knowledge centres filled with pods and racks of tremendous chips, related to large vitality and cooling methods.

(Tech bosses resembling Mark Zuckerberg have referred to some being the dimensions of Manhattan. The Google TPU lab is considerably extra modest, testing out the expertise for deployment elsewhere.)

Tales abound of tech bros begging chip makers for tons of of hundreds of those extremely engineered items of silicon. Take the current dinner at Nobu in Palo Alto, the place Elon Musk and Larry Ellison, the founder and head of Oracle, tried to woo Nvidia’s Jensen Huang, to promote them extra of them.

As Mr Ellison put it: “I might describe the dinner as me and Elon begging Jensen for GPUs. Please take our cash – no, no take extra. You are not taking sufficient. We’d like you to take extra, please!”

It’s exactly the race to entry the ability of as many as potential of those excessive efficiency chips, and to scale them up into huge knowledge centres, that’s driving an AI increase – and there is a notion that the one solution to win is to maintain spending.

The chips race – and the OpenAI storm

The terrace of the Rosewood Sand Hill resort, a sprawling 16-acre property close to the Santa Cruz mountains that serves crab rolls and $35 signature vodka martinis, is the place the large Silicon Valley deal-making will get executed. It is near Stanford College and Meta’s HQ, in addition to the headquarters of main enterprise capital companies.

There are whispered rumours about who shall be subsequent to announce customised AI chips – Asics – to compete with Google and Nvidia.

Simply earlier than I visited, one thing of a storm was brewing concerning the funding plans of OpenAI, which Elon Musk co-founded.

The agency, which began as a not-for-profit however has since established a business construction, has been the main focus of an online of cross-investments involving shopping for up chips and different laptop {hardware} wanted for AI processing.

Few within the business doubt OpenAI’s phenomenal person development – particularly the recognition of its chatbot, ChatGPT. It has ambitions to design its personal {custom} AI chips, however some have speculated about whether or not it would want authorities assist to attain this.

Getty Photographs

Getty PhotographsIn a podcast episode that aired final month, an OpenAI investor questioned how the corporate’s spending commitments tallied with its revenues, to which co-founder Sam Altman shot again, difficult the income figures quoted, and including: “If you wish to promote your shares, I am going to discover you a purchaser. Sufficient.”

He has since shared a prolonged put up on X, explaining, amongst different issues, that OpenAI is taking a look at commitments of about $1.4 trillion over the subsequent eight years and why he believes now’s the time to spend money on scaling up their expertise.

“I don’t assume the federal government ought to be writing insurance coverage insurance policies for AI firms,” he mentioned.

However he additionally mentioned: “What we do assume would possibly make sense is governments constructing (and proudly owning) their very own AI infrastructure.”

Getty Photographs

Getty PhotographsElsewhere, there have been notable very current falls in share costs of AI infrastructure firms – Coreweave, a start-up that provides OpenAI, noticed its shares lose 26% of their worth earlier this month.

Plus, there have been some reactions in markets for perceived credit score danger amongst different companies. And whereas most of those tech share costs have typically climbed larger over the course of 2025, there was a gentle dip extra typically previously few days.

ChatGPT versus Gemini 3.0

None of this has dampened the thrill over AI’s potential throughout the business. Google’s client AI mannequin, Gemini 3.0, launched to nice fanfare earlier this week — this can pitch Google in a direct battle with OpenAI and its still-dominant ChatGPT for the market share.

What we do not but know is whether or not it marks an finish to the times of chatbots going rogue and recommending glue as a pizza ingredient. So, is the top results of all this incredible funding is that info is much less dependable, I requested Mr Pichai.

“I believe should you solely assemble methods standalone and also you solely depend on that, [that] could be true,” he instructed me. “Which is why I believe we now have to make the knowledge ecosystem needs to be a lot richer than simply having AI expertise being the only real product in it.”

However I put it to him that reality issues. His response: “reality issues”.

Neither is the opposite huge query dealing with tech right this moment dampening the keenness round advancing AI’s potential. That’s: how on Earth to energy it?

By 2030, knowledge centres around the globe will use about as a lot electrical energy as India did in 2023, based on the IMF. But that is additionally an age the place vitality provide is beneath stress by governments committing to local weather change targets.

I put this to Google’s Mr Pichai, asking whether it is coherent to have ambitions to generate 95% of electrical energy from low-carbon sources by 2030 – because the UK authorities does – and likewise be an AI superpower?

“I believe it is potential. However I believe for each authorities, together with the UK, it is vital to determine learn how to scale up infrastructure, together with vitality infrastructure.

“You do not wish to constrain an financial system primarily based on vitality,” he provides. “I believe that may have penalties.”

Classes from the 2000 dotcom bust

Years in the past, as a fledgling reporter I lower my enamel within the 2000 dotcom bubble. It adopted a well-known speech by Federal Reserve Governor Alan Greenspan about “irrational exuberance”.

In that point I interviewed Steve Jobs twice, and some years later questioned Mr Pichai’s predecessor Larry Web page, and commentated dwell on the collapse of WorldOfFruit.com.

Via all of it, one lesson grew to become clear: that even within the worst-case eventualities and the hardest of crashes, disaster is not assured for all.

Take Amazon – its share value slumped to $6 and its market capitalisation fell to $4bn throughout that crash, but some 25 years on Jeff Bezos and his firm are very a lot going robust. In the present day Amazon is price $2.4 trillion.

The identical would, inevitably, be true of firms shaken by a possible AI bubble burst.

WireImage

WireImagePlus there’s one other looming issue that will nicely clarify why so many in Silicon Valley – and past – are blind to, or maybe selecting to not, acknowledge this danger, and pushing on regardless.

That’s, the attraction of the glittering prize on the finish: reaching synthetic basic intelligence (AGI).

That is the purpose at which machines match human intelligence, one thing many imagine is inside attain. Or past that, reaching synthetic super-intelligence (ASI), the purpose at which machines surpass our intelligence.

However I used to be additionally instructed one thing else that was thought-provoking by a Silicon Valley determine – that it would not matter whether or not there actually is a bubble or if it bursts. Step again and what’s going on within the larger image is a world battle for AI supremacy, with the US towards China taking centre stage.

And whereas Beijing funds these developments centrally, within the US it’s a messy however productive free market free for all, which implies trial and error on an epic scale.

For now, the US has superiority in silicon over China – firms like Nvidia with their GPUs and Google with their TPUs can afford to speed up into the storm.

Others will certainly fail, and spectacularly so, affecting markets, client sentiment and the world financial system. The bodily footprint left behind, nonetheless, containing sheer computing firepower for the deployment of mass AI applied sciences, will inevitably form our financial system and will nicely additionally form how we work and study – and who dominates the world for the remainder of the twenty first Century.

BBC InDepth is the house on the web site and app for the very best evaluation, with contemporary views that problem assumptions and deep reporting on the largest problems with the day. Now you can join notifications that may provide you with a warning at any time when an InDepth story is printed – click here to find out how.