Unlock the White Home Watch e-newsletter free of charge

Your information to what the 2024 US election means for Washington and the world

The creator is vice-chair at Oliver Wyman and former world head of banks and diversified financials analysis at Morgan Stanley

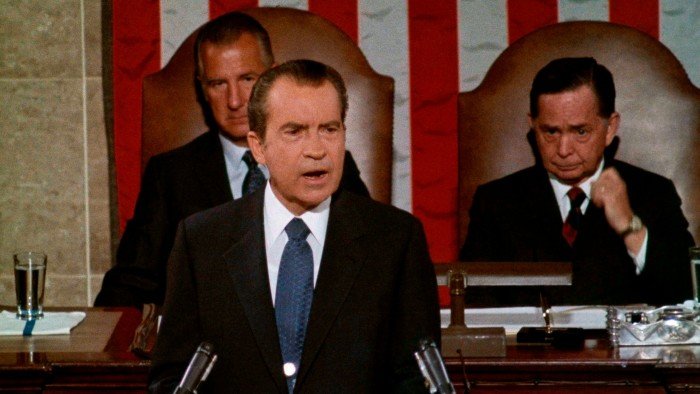

What’s going to the longer-term monetary penalties of Trump’s tariffs be? We could also be in a 90-day pause however the query stays pressing. A glance again at Richard Nixon’s expertise in 1971 may assist traders perceive what would possibly occur subsequent.

Actually latest occasions share some hallmarks with the “Nixon shock”, which occurred when the then president took the greenback off the gold commonplace, carried out a ten per cent import tariff and launched momentary value controls. This de-anchoring of the regime resulted in a interval of world financial instability and uncertainty. It not solely prompted a loss in enterprise confidence however led to stagflation. Nixon’s value and wage controls spectacularly backfired, triggering product shortages and serving to to gasoline a wage-price spiral. The entire episode was a pivotal contributor to the massive inflation of the ‘70s.

As with Trump’s tariffs, Nixon’s have been launched to cudgel international locations into altering the phrases of commerce to assist scale back the US commerce deficit. His greatest considerations have been Japan and Germany. “My philosophy, Mr President, is that each one foreigners are out to screw us and it’s our job to screw them first,” Treasury secretary John Connally had stated to him.

In at the moment’s hyperfinancialised world, we’ve got already seen that bond markets can drive the arms of politicians way more rapidly. It took 4 months in 1971 earlier than Nixon’s tariffs have been eliminated through the Smithsonian settlement. However the shock had already accomplished sufficient to catalyse extraordinary modifications in finance, resulting in the creation of recent devices to wager on the course of rates of interest and hedge foreign money danger, together with FX futures and choices.

The ache of stagflation within the banking system prompted an enormous change in monetary behaviour and monetary regulation. Traders shifted asset allocation to gold and actual belongings to protect worth. In the meantime corporates and depositors more and more moved their actions from banks to bond markets. Financial institution lending as a share of complete borrowing within the economic system has been falling ever since. In brief, trendy finance was solid within the early Seventies.

There are parallels as nicely for international locations outdoors the US at present worrying about tariffs. Again in 1971 there was additionally shoddy remedy for the US’s closest allies. Nixon hit Canada with tariffs regardless of its foreign money already floating. Like Prime Minister Mark Carney at the moment, Canadians didn’t again down and ultimately the tariffs have been eliminated. It may have been even worse: Connally had additionally wished the US to withdraw from a long-standing pact with Canada on automobiles and auto components. However Paul Volcker mounted that, in accordance with his memoirs, by cheekily encouraging a State Division official to tear off the final web page of each press launch which talked about it.

In the end, the necessity to stabilise worldwide relations with allies helped tip the steadiness away from the tariffs. Henry Kissinger, then the nationwide safety adviser, “grew involved concerning the unsettling impression of a protracted confrontation on allied relationships”.

Nixon additionally put big strain on the Fed for expansionary financial coverage to offset the shock. William Safire, Nixon’s speechwriter, recounts how the administration stored up a gradual stream of nameless leaks to strain Fed chair Arthur Burns, together with floating one proposal to broaden the scale of the Federal Reserve, in order that Nixon may pack the committee with supportive new members.

On the finish of all of it, Nixon’s four-month tax could have helped facilitate greenback revaluation, however it fell in need of the specified objectives and had no discernible impression on imports. The transfer’s financial shockwaves, nevertheless, rippled via the a long time. Even the creation of the euro stems from it. Would possibly a digital euro or deeper European capital markets be subsequent? It’s not but clear however historical past suggests the fallout from this newest shock might be felt for years to come back.