A Senate committee is investigating whether or not a distinguished cryptocurrency investor violated federal tax legislation to save lots of a whole lot of thousands and thousands of {dollars} after he moved to Puerto Rico, a well-liked offshore tax haven, in accordance with a letter reviewed by The New York Instances.

Senator Ron Wyden, an Oregon Democrat, despatched the letter on Jan. 9 to Dan Morehead, the founding father of Pantera Capital, one the biggest crypto funding companies.

The letter mentioned the Senate Finance Committee was investigating tax compliance by rich People who had moved to Puerto Rico to reap the benefits of a particular tax break for the island’s residents that may scale back tax payments to zero.

The investigation was targeted on individuals who had improperly utilized the tax break to keep away from paying taxes on revenue that was earned outdoors Puerto Rico, in accordance with the letter.

“Normally, the vast majority of the acquire is definitely U.S. supply revenue, reportable on U.S. tax returns, and topic to U.S. tax,” the letter mentioned.

The letter requested detailed data from Mr. Morehead about $850 million in funding income he made after transferring to Puerto Rico in 2020, noting that he “might have handled” the positive factors as exempt from U.S. taxes.

Mr. Morehead mentioned in an announcement that he moved to Puerto Rico in 2021. “I imagine I acted appropriately with respect to my taxes,” he mentioned.

Mr. Wyden was chairman of the Finance Committee till Republicans took management of the Senate final month. Throughout his tenure, the committee investigated a number of methods that rich People have used to keep away from paying taxes.

It’s unclear what might come of the investigation. Beneath the Biden administration, federal regulators and Democratic lawmakers cracked down on the crypto trade and distinguished tech figures. President Trump and Republicans in Congress have embraced crypto, promising much less aggressive enforcement.

A spokesman for Mr. Wyden mentioned the investigation was “ongoing” and declined additional remark. A spokeswoman for the Finance Committee’s new chair, Senator Michael D. Crapo of Idaho, didn’t reply to a request for remark.

For greater than a decade, rich People, together with many tech entrepreneurs, have flocked to Puerto Rico to reap the benefits of Act 60, a tax break established in 2012 underneath a unique identify. Any capital positive factors revenue generated within the U.S. territory isn’t topic to native or federal revenue tax.

In recent times, the Justice Division, the Inner Income Service and lawmakers have investigated abuses of that system. The I.R.S. has mentioned its legal division recognized about 100 individuals who might have dedicated tax evasion.

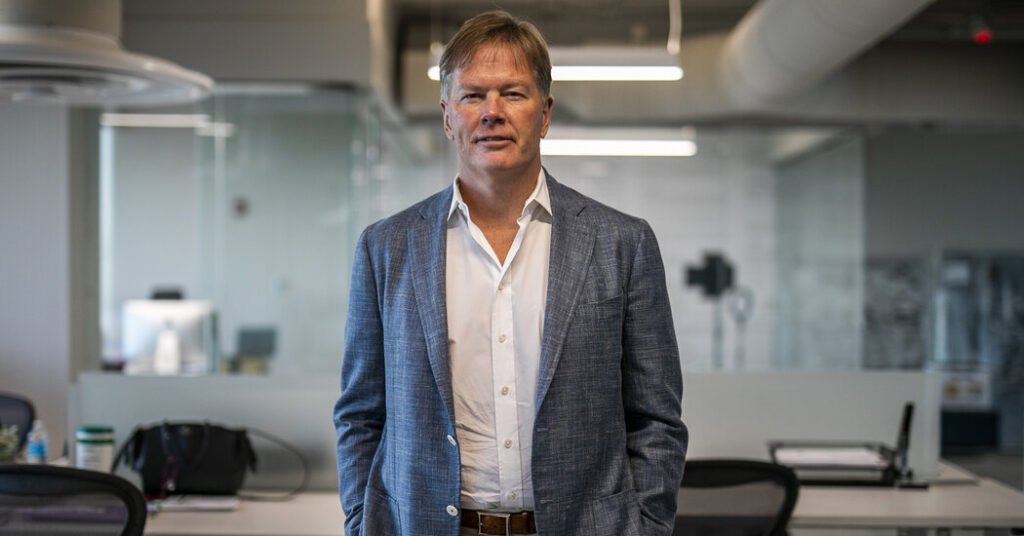

A former Goldman Sachs dealer, Mr. Morehead based Pantera within the early 2000s and turned it into one of many largest funding companies targeted on crypto, backing more than 100 crypto companies during the last 12 years. These embrace main U.S. crypto companies equivalent to Circle, Ripple and Coinbase, which operates the biggest market for digital currencies in the USA.

After Mr. Morehead moved to Puerto Rico, Pantera offered “a big place” and generated capital positive factors “in extra of $1 billion,” in accordance with Mr. Wyden’s letter. Mr. Morehead’s share of the positive factors totaled greater than $850 million, the letter mentioned.

The letter requested Mr. Morehead to share data associated to these transactions, together with the names of his tax advisers. It additionally requested him to share an inventory of any property he offered whereas a resident of Puerto Rico, together with cryptocurrencies.