Enterprise editor

Rolls-Royce

Rolls-RoyceRolls-Royce’s plan to energy synthetic intelligence (AI) with its nuclear reactors may make it the UK’s most useful firm, its boss has stated.

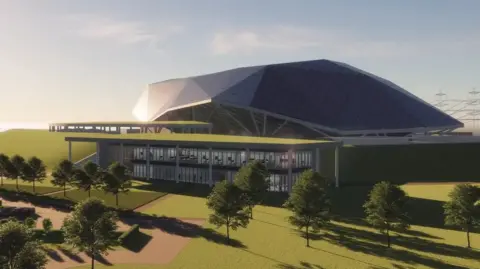

The engineering agency has signed offers to supply small modular reactors (SMRs) to the UK and Czech governments.

AI has boomed in reputation since 2022, however the expertise makes use of numerous vitality, one thing which has raised sensible and environmental issues.

Rolls-Royce chief govt Tufan Erginbilgic instructed the BBC it has the “potential” to turn out to be the UK’s highest-valued firm by overtaking the biggest corporations on the London Inventory Alternate because of its SMR offers.

“There isn’t any non-public firm on the earth with the nuclear functionality we’ve got. If we aren’t market chief globally, we did one thing fallacious,” he stated.

Mr Erginbilgic has overseen a ten-fold improve in Rolls-Royce’s share value since taking on in January 2023.

Nonetheless, he has dominated out the concept of Rolls-Royce in search of to listing its shares in New York as British chip designer Arm has executed and the likes of Shell and AstraZeneca have thought-about within the seek for increased valuations.

That is although 50% of its shareholders and clients are US-based.

“It is not in our plan,” stated Mr Erginbilgic, a Turkish vitality trade veteran. “I do not agree with the concept you possibly can solely carry out within the US. That is not true and hopefully we’ve got demonstrated that.”

Rolls-Royce already provides the reactors that energy dozens of nuclear submarines. Mr Erginbilgic stated the corporate has an enormous benefit sooner or later market of bringing that expertise on land within the type of SMRs.

SMRs are usually not solely smaller however faster to construct than conventional nuclear vegetation, with prices prone to come down as items are rolled out.

He estimates that the world will want 400 SMRs by 2050. At a price of as much as $3bn (£2.2bn) every, that is one other trillion dollar-plus market he desires and expects Rolls-Royce to dominate.

The corporate has signed a deal to develop six SMRs for the Czech Republic and is growing three for the UK.

Nevertheless it stays an unproven expertise. Mr Erginbilgic conceded he couldn’t at present level to a working SMR instance however stated he was assured in its future potential.

There are additionally issues concerning the calls for on water provides from the info centre and SMR cooling methods.

In response, corporations together with Google, Microsoft and Meta have signed offers to take vitality from SMRs within the US when they’re accessible.

Rolls-Royce sees SMRs as key to its future, however its greatest enterprise is plane engines.

Already dominant in supplying engines to wide-bodied plane like Boeing 787 and Airbus A350, it plans to interrupt into the subsequent era of narrow-bodied plane just like the Boeing 737 and Airbus A320. This market is value $1.6tn – 9 instances that of the wide-bodied .

Rolls-Royce is a bit participant in a market that has highly effective and profitable leaders, and that rival Pratt and Witney misplaced $8bn attempting and failing to interrupt into.

The market is dominated by CFM Worldwide – a three way partnership between US-based GE Aerospace and French firm Safran Aerospace Engines.

Business veterans instructed the BBC that market leaders can and can drop costs to airline clients lengthy sufficient to see off a brand new assault on their market dominance.

However Mr Erginbilgic stated this isn’t simply the most important enterprise alternative for Rolls-Royce. Quite, it’s “for industrial technique… the only greatest alternative for the UK for financial progress”.

“No different UK alternative, I problem, will match that,” he stated.

Though Rolls-Royce bought its automotive making enterprise to BMW almost 30 years in the past, the title of the corporate remains to be synonymous with British engineering excellence.

However within the early a part of this decade that shine had worn off. The corporate was closely indebted, its revenue margins have been non-existent, and hundreds of employees have been being laid off.

When Mr Erginbilgic took over in January 2023, he likened the corporate to “a burning platform”.

“Our price of capital was 12%, our return was 4% so each time we invested we destroyed worth,” he stated.

Two and a half years later, the corporate expects to make a revenue of over £3bn, its debt ranges have fallen and shares have risen over 1,000% – a ten-fold rise.

So how did that occur? And is Mr Erginbilgic proper to suppose that Rolls-Royce’s roll is simply simply beginning?

‘Grudging respect’

The timing of his appointment was lucky in line with some trade veterans.

Rolls-Royce’s greatest enterprise – supplying engines to business airways – has rebounded strongly from the Covid pandemic.

The corporate’s most profitable product – the Trent sequence of plane engines – are on the candy spot of profitability because the returns on funding of their growth over a decade in the past start to pour into firm coffers.

Russia’s full-scale invasion of Ukraine in 2022 arguably made it nearly inevitable that its defence enterprise would see increased spending from European governments – which has been confirmed by current bulletins.

Unions haven’t at all times been followers of Mr Erginbilgic’s hard-charging strategy.

In October 2023, one among his first main transfer was chopping jobs, which drew criticism from Sharon Graham, the boss of the Unite union.

“This announcement seems to be about appeasing the markets and its shareholders whereas ignoring its employees,” she stated on the time.

Nonetheless, general world headcount has grown from 43,000 to 45,000 since 2023 and union sources say there’s “grudging respect” for Mr Erginbilgic.

These sources give him one third of the credit score for the turnaround round within the firm’s fortunes, with a 3rd credited to market situations and a 3rd to his predecessor Warren East for “steadying the ship”.

So does Mr Erginbilgic actually consider that Rolls-Royce could be the UK’s most useful firm – overtaking the likes of AstraZeneca, HSBC, and Shell?

“We at the moment are quantity 5 within the FTSE. I consider the expansion potential we created within the firm proper now, in our current enterprise and our new companies, truly sure – we’ve got that potential.”

Rolls-Royce is undoubtedly an organization with the wind at its again – and Tufan Erginbilgic actually believes he has set the sails good.

Get our flagship e-newsletter with all of the headlines that you must begin the day. Sign up here.