SINGAPORE: Nvidia’s shares climbed on Wednesday (Nov 19) after posting solid quarterly profits and revenue that exceeded Wall Avenue’s expectations.

The carefully watched outcomes offered a pulse verify amid issues about a synthetic intelligence bubble – and Nvidia’s earnings seem to have cooled worries, for now.

Was the speak of an AI bubble overblown, and what’s in retailer for Nvidia?

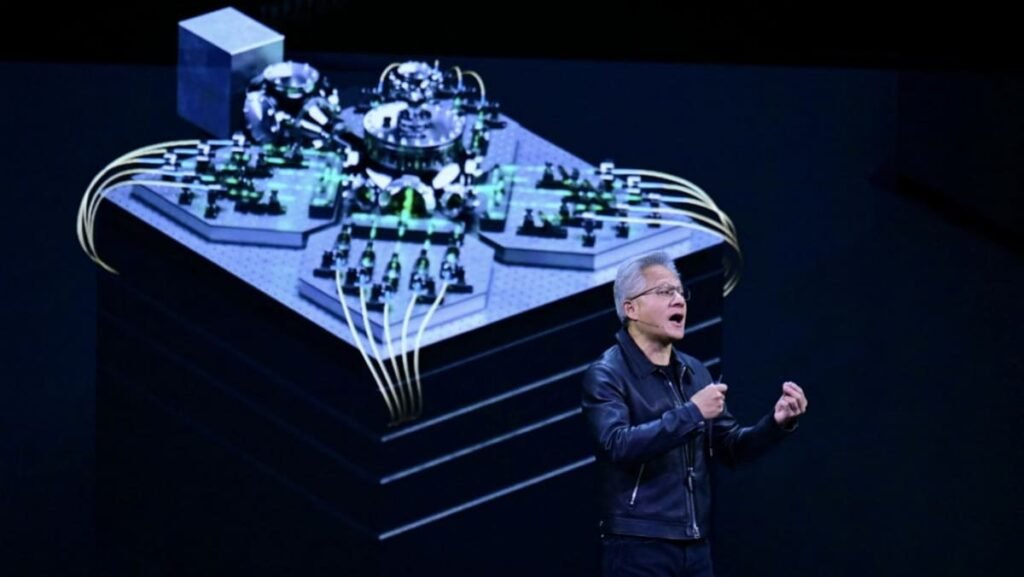

JENSEN HUANG QUELLS JITTERS

In a convention name, Nvidia CEO Jensen Huang seized the second to push again in opposition to the sceptics.

“There’s been quite a lot of speak about an AI bubble. From our vantage level, we see one thing very completely different,” Huang stated.

“Blackwell gross sales are off the charts, and cloud GPUs are bought out,” he added, referring to the corporate’s most superior chips.

He reiterated a forecast from final month that the corporate had US$500 billion in bookings for its superior chips by way of 2026.

“The explanation why builders love us is as a result of we’re actually all over the place,” he added. “We’re all over the place from cloud to on-premise to robotic methods, edge units, PCs, you title it. One structure. Issues simply work. It is unimaginable.”

Nvidia reported third-quarter income of US$31.9 billion, up 65 per cent from the quarter a yr in the past.

Income climbed 62 per cent to US$57 billion.

The world’s most beneficial firm additionally predicted that its income for the fourth quarter will are available in at about US$65 billion. That’s almost US$3 billion above analysts’ projections, in a sign that demand for its AI chips stays feverish.

NVIDIA’S RISE

Nvidia, based in 1993, was already a frontrunner in making GPUs, the elements that generate pictures on a pc display.

The Silicon Valley firm later found that it might tailor GPUs from powering video video games to serving to prepare highly effective AI methods.

When generative AI began to make headlines three years in the past, fuelled by OpenAI’s launch of ChatGPT, demand for Nvidia’s merchandise skyrocketed.

Its top-of-the-line Blackwell vary of chips, particularly, is extremely wanted.