COMMENT: The remark you posted was appropriate. Jim Cramer at all times mentioned unhealthy information is sweet information. He and everybody else proceed to advocate for decrease rates of interest, and you’ve got proven that when charges decline, so does the financial system and inventory markets. It appears to be like like Trump shouldn’t be a lot better along with his fixed assault on the Fed.

Joe

ANSWER: I’m a dealer – not a promoter, tutorial, or a TV host. Whenever you even have pores and skin within the recreation, you can not commerce based mostly on silly theories. The truth that these individuals can say that BS time and time once more that decrease charges are appropriate for the financial system, makes the phrase STUPID and a praise to their psychological functionality, for they haven’t but invented a phrase to explain their cognitive potential, which appears to be so myopic that they’re on the degree of an ameba.

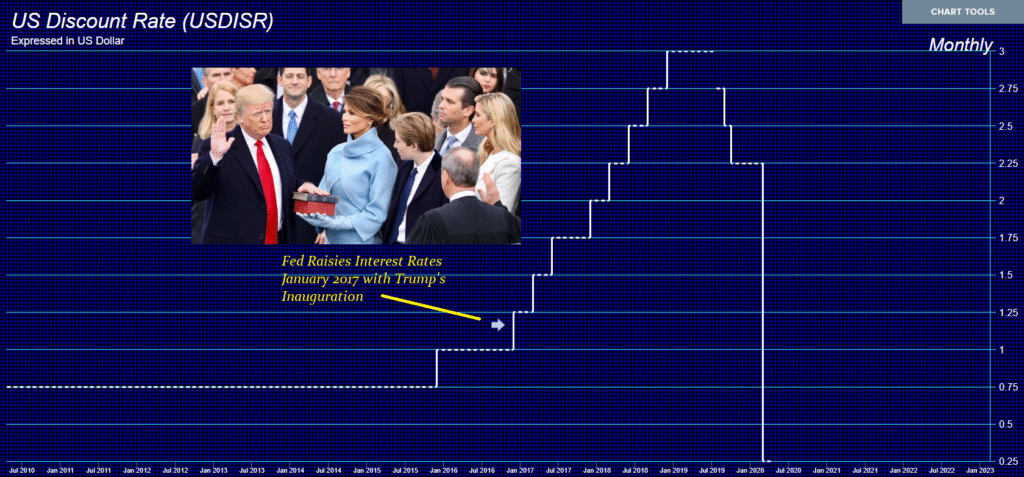

I agree, Trump’s assault on the Fed is totally lifeless mistaken. The Fed has lowered charges throughout the Nice Melancholy and each single recession proper as much as the 2007-2009 recession with ZERO affect in any way. Irrespective of how loud I scream, they may NEVER change this propaganda, and they won’t solely doom the nation, but additionally trigger a whole lot of financial hurt to individuals who act on this propaganda.

The ECB went NEGATIVE on rates of interest in 2014 and maintained that till 2022, with ZERO affect on reversing the financial downtrend. They may NEVER be taught, and that is what 2032 is all about. These in energy neither perceive how the financial system capabilities nor do they care about making an attempt even to determine it out.

It doesn’t matter what you present a Democrat, it simply makes them “really feel all heat and fussy” inside to harm individuals who have greater than they do. They refuse to take a look at historical past and present simply as soon as the place their theories have EVER labored a single time. We’ve the identical entrenched stupidity on the appropriate with this nonsense that decreasing charges is sweet for the financial system. We’re doomed due to this foolishness on each side and the REFUSAL even to look to see if this propaganda is true or mistaken.

The inventory market has NEVER peaked on the similar degree twice in historical past. The height in Name Cash was 1899, and the explanation was a monetary disaster in Britain that pressured capital to be recalled from the rising markets, which was, again then, the USA. The capital outflows led to shortages in money, inflicting charges to rise. In 1929, the largest rally occurred, with charges at their lowest, as capital from all over the world concentrated within the USA following World Struggle I.

The goldbugs have informed everybody to promote shares and that solely gold will rise. Just like the Marxists, it simply makes them really feel heat and fuzzy inside to hate shares and preach solely gold, however will NEVER examine what they’re saying. That is what makes it so hopeless.

Even throughout the Nice Melancholy, probably the most well-known analyst was Irving Fisher. He predicted that the market had reached a brand new plateau and implied it might by no means crash. He was lifeless mistaken, and his fame was severely impacted. Irving Fisher’s modern public fame was totally destroyed by the 1929 crash, primarily due to a famously ill-timed assertion.

Galbraith’s socialist philosophy clouded his view of the Nice Melancholy, blaming hypothesis and the personal sector whereas ignoring the federal government defaults from Europe and Asia that contributed to the collapse of 9,000 banks. The first concern in evaluation is that individuals usually begin with a principle and try and show it, fairly than genuinely studying from the information.

Each single BS principle these individuals espouse is simply utter nonsense. They’ve NEVER checked out markets and are incapable of fundamental analysis. They open their mouths and spit out phrases merely as a result of everybody else does, and they’re scared to dying of peer evaluate by but different idiots. Sure, I’ve fought in opposition to the bankers, the Deep State, and numerous intelligence organizations, and all attempt to silence me and put out BS, determined to attempt to stop individuals from merely understanding actuality.

Even the entire nonsense that currencies are FIAT and solely gold will survive is one other absolute piece of uncooked BS. Once more, they simply take the Austrian College nonsense and by no means take a look at the financial system at that time in historical past, when in reality the trade charges between currencies have been purely based mostly on the steel content material. There was no actual superpower or centralized dominant financial system after they have been making an attempt to provide you with explanations of a course of they didn’t absolutely perceive. The primary non-metal financial system was based mostly on a central ledger system of entries in historical Egypt. Cash was primarily equal to wheat that they deposited in a financial institution, and so they have been the primary to implement a GIRO banking system on the planet. You might switch cash out of your account to a different (GIRO), which didn’t seem till the Italian bankers of the Center Ages. The Egyptians didn’t use cash till they have been conquered by Alexander the Nice in 332BC. So for hundreds of years, it was purely ebook entries in a financial institution.

To ensure that Egypt to interact in worldwide commerce, it issued imitations of Athenian Owls. This proved that the worth of an Athenian Owl was price greater than the steel content material. They may have issued their very own coinage, however didn’t. They imitated the Athenian Owl as a result of that was the acknowledged forex in worldwide commerce. There was a premium to the steel content material or “fiat”; it was backed by Athens itself, not the steel content material. As a substitute, its worth comes from the belief individuals place within the authorities that points it and the actual fact that it’s the solely legally accepted type of cash for paying money owed and taxes. The phrase “fiat” comes from Latin and means “let it’s completed” or “by decree.” Primarily, the forex has worth as a result of the federal government says it does, or as a result of the individuals belief that authorities over others.

The Celts routinely imitated the coinage of Macedonia, beginning with the gold of Philip II after which the silver of his son Alexander the Nice. Once more, this demonstrated that there was a premium to the coinage over and above that of the steel content material. That is the very definition of a fiat forex, whose worth relies on the truth that the federal government points it.

India was the supply of the spice commerce. They dealt extensively with Rome and Roman cash that circulated in India. They too imitated Roman coinage, and once more, the worth of the forex was NOT the steel content material, however who do you belief? Proof of that assertion is right here, an Indian imitation gold aureus which weighs almost 60% greater than a real gold aureus of Rome.

India was nonetheless imitating the coinage of the Venetian Empire throughout the 18th century. Issuing gold within the type of probably the most acknowledged forex in world commerce confirms that the worth of the forex was greater than the steel content material.

The Austrian Maria Theresia Thalers are maybe probably the most imitated coin, for they have been utilized in worldwide commerce by far. She died in 1780, so that they continued to strike cash dated 1780, the yr of her dying. Once more, the steel content material is usually appropriate, exhibiting that the cash have been acceptable internationally.

Luckily, you’ll NEVER persuade a idiot that he’s silly. There will likely be loads of these individuals who will refuse to hear. They MUST lose their shirts, pants, the home, automobile, the spouse, and the children earlier than they may ever perceive. We be taught ONLY from our errors – not our victories. So there will likely be a herd for us to commerce in opposition to.