Unlock the Editor’s Digest totally free

Roula Khalaf, Editor of the FT, selects her favorite tales on this weekly publication.

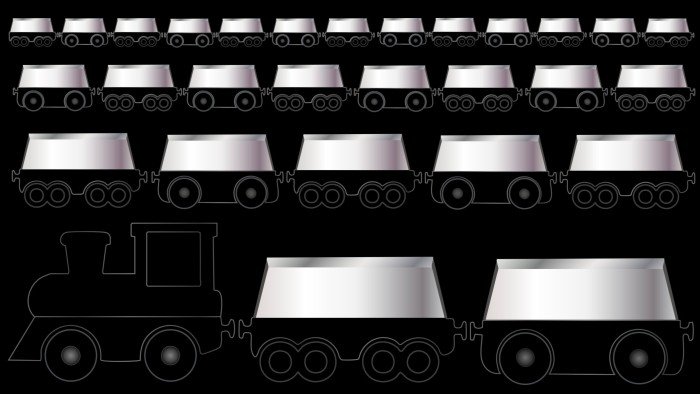

Again in 1857, the Financial institution of Austria loaded 10mn ounces of silver on to a prepare and dispatched it to Hamburg. The explanation? The town’s banks had been about to break down, having run out of reserves.

So Austria despatched that “silver prepare” to offer liquidity. And 30 years later the French central financial institution did the identical with a ship of gold, throughout Britain’s Barings disaster.

May such assist be wanted once more, in a Twenty first-century greenback kind? It’s a query now being quietly mulled amongst European and Asian central bankers, in relation to the once-arcane situation of central financial institution greenback swap traces. Traders ought to pay shut consideration.

The reason being that these swap traces have been considered a core pillar of the worldwide monetary system in latest a long time, since they’ve enabled main Asian and European central banks to get {dollars} from the US Federal Reserve in a disaster. That is crucially essential as a result of in instances of market stress there may be often a “sprint for money” — that’s, a scramble for {dollars}, given the dollar’s position as a reserve forex.

Nevertheless, non-US entities can not print these {dollars}, and so might not have the ability to meet demand. Thus throughout the 2008 monetary disaster, the Fed activated some $583bn in swap traces for non-US central banks, to allow {dollars} to move to business banks.

It did the identical throughout the Eurozone disaster and then provided $450bn during the Covid pandemic in 2020 — a transfer that quelled monetary contagion, in response to the Richmond Fed.

However doubts are actually creeping in concerning the reliability of that security internet. In spite of everything, the administration of US President Donald Trump appears decided to reset the worldwide monetary and financial order and to place American pursuits first. JD Vance, the vice-president, has noticed that he “simply hate[s] bailing Europe out”.

Offers with allies, in different phrases, now not appear sacred. Simply have a look at this week’s revelation that the Pentagon is reviewing its submarine pact with the UK and Australia.

Fed officers, for his or her half, vehemently deny that the greenback swaps system may echo this submarine story. Certainly Jay Powell, Fed chair, pressured its deserves throughout a speech in Chicago in April.

However what worries some outside the US is what would possibly occur when Powell leaves in 2026. The Fed at present has everlasting greenback swap services with 5 central banks (within the Eurozone, Switzerland, Japan, Britain and Canada) and it beforehand created momentary services for 9 others, together with Australia, Brazil and Denmark, which have expired.

It’s unclear whether or not these latter services can be restored in a crunch — and, if that’s the case, at what “value”. If the Fed provided swaps to the Danish central financial institution, say, would Trump demand concessions on Greenland? It’s also unclear whether or not Washington would possibly connect circumstances to the everlasting swap traces. In spite of everything, Scott Bessent, Treasury secretary, views finance, army, commerce and tech points as being deeply entwined.

Then there may be Congress, which has final authority over the Fed. After the 2008 disaster, there was some bipartisan congressional criticism of the swaps line, which Fed officers largely quelled by noting {that a} world monetary panic would have damage America. However this criticism may simply return, significantly given Trump’s protectionist and populist instincts.

Therefore the necessity for Europe to ponder that 1857 “silver prepare”. Final month Luis de Guindos, European Central Financial institution vice-president, insisted that the ECB remained assured the Fed would retain the swap traces. However it recently emerged that the ECB has requested its banks to report vulnerabilities round their greenback exposures.

And an article revealed by the influential CEPR think-tank has now called for non-US central banks to create a mutual pact to arrange for a worst-case situation. The thought can be for 14 central banks to make use of their estimated $1.9tn greenback holdings to increase liquidity to one another, if the Fed retreated, in co-ordination with the Financial institution for Worldwide Settlements.

No central banker has publicly backed this concept. However some inform me that many contingency plans are being mentioned. And within the meantime, they’re quietly taking different defensive steps, comparable to raising their purchases of gold, and, within the case of smaller international locations, chopping swap offers with China.

“There’s debate concerning the Kindleberger lure,” one tells me, referring to the economist Charles Kindleberger’s warning that turbulence erupts when a dominant geopolitical energy loses the flexibility or need to assist a reserve forex, with out its ascendant rival getting into the breach. (That is what occurred within the interwar years earlier than sterling was changed by the greenback.)

We’re emphatically not at such a Kindleberger second now — and we should hope it by no means comes. However the important thing level is that this: until the White Home clearly helps Powell’s feedback about the necessity to protect greenback swap traces, unease will develop. So allow us to all belief that Bessent, as a monetary historical past buff, recognises this, and acts. If not the worth of gold will carry on rising.