Amid all of the blaring headlines popping out of Washington, D.C., right here’s a bit of reports that’s getting far too little consideration: The U.S. is on the right track for fiscal breakdown.

That’s the unambiguous message from the Congressional Funds Workplace’s newly up to date long-term projections. Except Congress modifications course, there’ll be a reckoning, and it is going to be grim.

Because the CBO particulars, deficit spending is extra uncontrolled than ever. Each events share the blame, as do each ends of Pennsylvania Avenue. And all ought to keep in mind that buyers’ urge for food for U.S. authorities debt isn’t limitless.

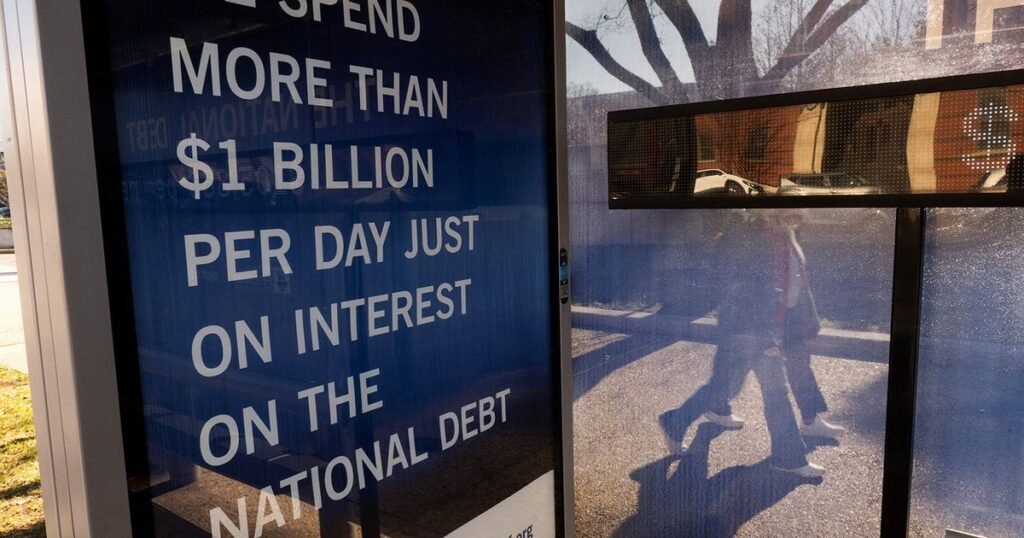

The federal authorities is presently spending roughly $7 trillion and gathering solely $5 trillion in taxes yearly. The ensuing deficit is slightly over 6% of gross home product, a disturbingly excessive quantity for an financial system round full employment.

The CBO expects public borrowing to stay at this elevated degree or greater for many years. Assuming no recessions, public debt will rise to 100% of GDP this yr and 118% by 2035 — and it simply retains rising from there.

A accountable Congress would make deficit discount its overriding precedence. As an alternative, Republicans are discussing methods to borrow extra — and never just a bit extra. New tax cuts are into consideration. And plenty of wish to lengthen provisions of the 2017 Tax Cuts and Jobs Act, which might in any other case expire on the finish of this yr.

Extending the legislation in full would improve the nationwide debt by roughly $5 trillion over the following decade and $40 trillion over 30 years. The debt ratio in 30 years would soar to greater than 200% of GDP.

Larger tariff revenues received’t come near balancing the books. In truth, the influence on total income is more likely to be adverse, as a result of tariffs depress business exercise and job creation.

Financial savings from slashing the federal payroll received’t have any considerable impact, both. For all of the media consideration generated by cuts to personnel and packages — and a few of them are warranted — they’re having nearly no influence on restraining the finances deficit.

Making issues worse, the mass layoffs and program cuts are being made with out concern for the supply of public companies that voters rely upon. Once they see that public parks are closed, well being care is declining and deaths from infectious illness have gotten extra frequent, they’ll be indignant.

Republicans could pay a steep value when the midterm elections roll round subsequent yr, however regardless: The present method to governing isn’t tenable in the long term.

In some unspecified time in the future, lengthy earlier than the debt reaches stratospheric heights, monetary markets — if not voters — will say sufficient is sufficient. Bond costs will collapse, long-term rates of interest will spike and the federal government will default — both explicitly or behind the cloak of surging inflation.

Restoring fiscal management ought to be job No. 1 for this Congress. The one wise method is to mix reasonable tax will increase and even handed cuts in spending. Spreading the burden would permit the modifications to be extra palatable and gradual, in the event that they’re undertaken quickly.

Components of the Tax Cuts and Jobs Act are price preserving: The larger normal income-tax deduction and stronger funding incentives, for instance, are pro-growth. However all such extensions, and another new measures, ought to be greater than matched by decrease spending and better taxes total, to ship a considerable internet discount in projected deficits.

Congress has already delayed too lengthy, however the price of delaying additional — and worse, compounding the issue with further deficit spending — may have devastating financial penalties.

In Washington, D.C., the most important scandals are sometimes hiding in plain sight. Except Congress and the administration get severe about deficit discount, People will quickly see the prices pile up round them.