Some imagine that Donald Trump is intentionally trying to trigger a pointy downturn in equities to drive a flight into treasuries. In that case, the Federal Reserve would have extra of a purpose to slash rates of interest—Trump’s longstanding need. Trump has acknowledged that the markets are present process an “operation” of kinds, however I might not underestimate his long-term plan right here.

Trump overtly states that he desires firms to maneuver manufacturing to the US to keep away from tariffs. This can even promote home commerce as firms will search to keep away from levies. US farmers might be incentivized to promote domestically, which may decrease the worth of groceries a lot to the pleasure of the American public.

The concept a decline within the inventory market may really trigger a flight into treasuries sounds counterintuitive on the floor, however once you perceive how capital flows and confidence function globally, it makes good sense. Capital strikes globally and all the time seeks the most secure place to park. Unexperienced and retail merchants are inclined to panic at bigger downturns and dump.

Every little thing comes right down to CONFIDENCE. A downturn in equities may trigger a kneejerk response into treasuries as a result of individuals nonetheless belief that the federal government will make good on their funds. Massive institutional cash started fleeing the general public sector for the personal sector years in the past. What we have now seen because the implementation of Trump’s tariffs is a brand new demand for treasuries.

The 10-year treasury yield dropped from 4.25% in late March 2025 to 4.01% by April 1, whereas the two-year fell to three.68%. Billions have fled into the bond market since these tariffs had been introduced. JPMorgan, for instance, mentioned that there’s now a 60% threat of a recession and is shifting towards the bond market.

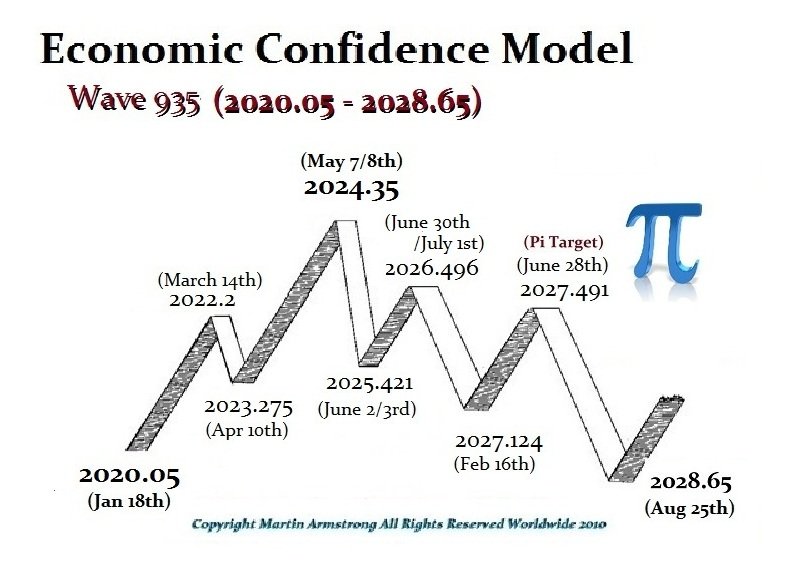

Reducing treasury charges will make houses extra reasonably priced by lowering mortgage charges. Particular person nations had been fleeing US treasuries, creating a large threat for an eventual default. Out of the blue, at the least quickly, the inventory market not looks like a protected place to park cash. The Trump Administration first confirmed the world that it was reducing spending and trying to cut back the deficit. A downturn in rallies DOES NOT assure a rally within the bond market, however we’re witnessing a short-term move into treasuries. Nonetheless, the pc has warned that 2028 will mark a serious turning level in confidence the place any remaining confidence in authorities vanishes. For now, we might take pleasure in a brief decline in treasury yields attributable to these tariffs.