Unlock the Editor’s Digest free of charge

Roula Khalaf, Editor of the FT, selects her favorite tales on this weekly e-newsletter.

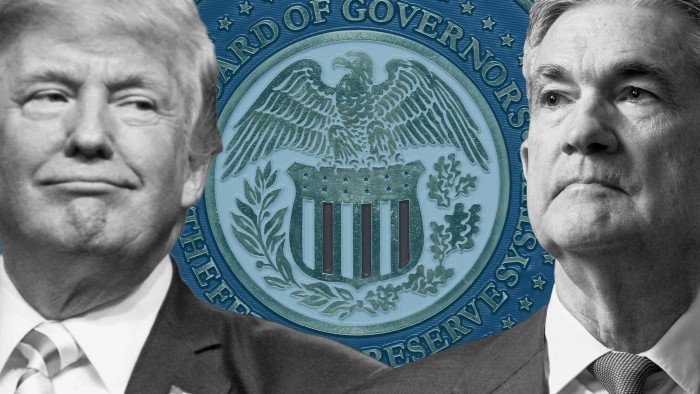

Donald Trump’s tariffs have opened a schism on the Federal Reserve as prime policymakers spar over whether or not to chop rates of interest as quickly as this summer time or maintain them regular for the rest of 2025.

Christopher Waller, a Fed governor seen as a candidate to switch Jay Powell as its subsequent chair, on Friday known as for a fee reduce as quickly as subsequent month and performed down the dangers that US president’s levies would push up inflation.

“We’ve been on pause for six months considering that there was going to be an enormous tariff shock to inflation. We haven’t seen it,” Waller, who grew to become a Fed governor in 2020 after Trump nominated him to the publish throughout his first time period, mentioned in a CNBC interview.

“We must be basing coverage . . . on the info.”

Waller’s feedback got here simply two days after the Fed kept rates on hold for its fourth assembly in a row in a unanimous choice, following 1 proportion level of reductions in 2024.

Trump has sharply criticised the Fed for not slashing charges, with the president this week calling for as a lot as 2.5 proportion factors of cuts and deriding Powell as an “American shame”.

He additionally mused about whether or not he ought to “appoint myself” to the world’s most influential central financial institution.

A set of projections launched on Wednesday confirmed a widening divide among the many central financial institution’s prime policymakers on whether or not or not they might be capable of reduce charges a number of instances this 12 months — or under no circumstances.

Powell, whose time period as Fed chair ends in Might 2026, acknowledged on Wednesday that there was a “fairly wholesome range of views on the committee”, however famous that there was “sturdy help” for the choice to maintain rates of interest on maintain for now.

The Fed chair additionally anticipated that variations amongst committee members would “diminish” as soon as extra information on the economy got here in over the approaching months. “With uncertainty as elevated as it’s, nobody holds these fee paths with plenty of conviction,” he mentioned.

There have been nonetheless 10 members anticipating two or extra quarter-point cuts this 12 months, in line with Wednesday’s financial projections. However seven now forecast no fee cuts and two expect one reduce.

“One notable factor is the variety of Fed officers who assume there must be no cuts has grown. There’s clearly a distinction in opinion among the many committee,” mentioned Rick Rieder, BlackRock’s chief funding officer for world mounted earnings, who oversees about $2.4tn in property.

The controversy on the Fed centres on whether or not to maintain borrowing prices increased due to expectations that Trump’s tariffs will elevate costs, or reduce charges to offset any softening of financial progress.

Charges at 4.25-4.5 per cent are thought-about to be above the so-called impartial degree, which neither accelerates nor slows the financial system.

The Fed’s projections this week confirmed that policymakers general count on a big slowdown in progress this 12 months and a rise in inflation.

However worth will increase from tariffs to this point have remained muted, with the Might studying for shopper worth index inflation final week coming in softer than anticipated, with costs rising 2.4 per cent from the earlier 12 months. Whereas some officers assume the US jobs market stays strong, others consider the labour market is weakening in some sectors.

Powell on Wednesday warned that the central financial institution’s “obligation is to maintain longer-term inflation expectations properly anchored”. Inflation stays above the Fed’s goal of two per cent.

“In the interim, we’re properly positioned to attend to be taught extra concerning the doubtless course of the financial system earlier than contemplating any changes to our coverage stance,” he mentioned.

Futures markets sign that traders count on two quarter-point cuts this 12 months, starting in October, in line with Bloomberg information.

“I believe Waller was reflecting actually on how the Fed is lots nearer to reducing than they’re letting on, they simply want some form of a extra definitive affirmation from the financial system that they should transfer,” mentioned Steven Blitz, chief US economist at TS Lombard.