If you happen to have been to ask the highest chief executives on the planet to call one of the best technique to assault waste of their organizations and stability the books, there may be one reply you’ll be very, most unlikely to listen to: Take an ax to accounts receivable, the a part of a corporation liable for gathering income.

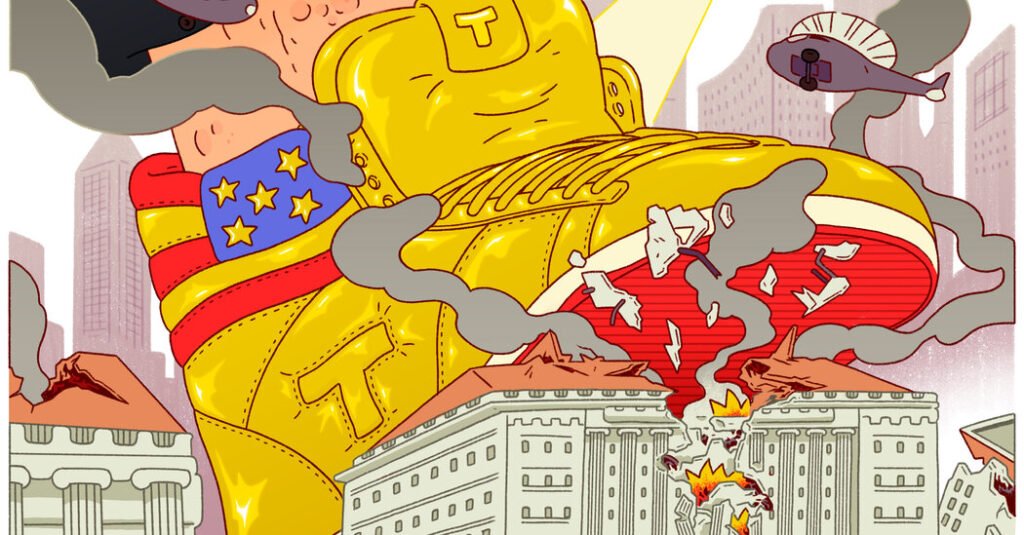

But the non-public sector leaders advising President Trump on methods to extend authorities effectivity are deploying this actual method by focusing on the Inside Income Service, which collects nearly all of the receipts of the U.S. authorities — our nation’s accounts receivable division. Final week, the Trump administration began shedding about 6,700 I.R.S. staff, many if not most of whom are immediately concerned in gathering unpaid taxes.

Yearly, the federal government receives a lot much less in taxes than it’s owed. Closing that hole, which stands at roughly $700 billion yearly, would nearly actually require sustaining the I.R.S.’s assortment capability. Depleting it’s tantamount to a chief govt saying one thing like: “We bought lots of items and providers this 12 months, however let’s restrict our capability to gather what we’re owed.”

Maybe solely the corporate’s opponents would approve of such an method. But right here we’re. Aggressive cuts to our nation’s accounts receivable perform will scale back the quantity of tax income coming in, which can in flip enhance our nation’s deficit and add to our $36 trillion in debt.

So why go down this path? Let’s be clear: Shrinking the I.R.S. is not going to decrease your tax obligation. That’s as much as Congress.

Aggressive reductions within the I.R.S.’s assets will solely render our authorities much less efficient and fewer environment friendly in gathering the taxes Congress has imposed. It is going to shift the burden of funding the federal government from individuals who shirk their taxes to the trustworthy individuals who pay them, and it’ll impede efforts by the I.R.S. to modernize customer support and simplify the tax submitting course of for everybody.

I.R.S. staff are moms, fathers, individuals of religion, Little League coaches, group volunteers and neighbors. Hundreds are additionally veterans or members of navy households. Greater than 98 p.c stay exterior the Washington, D.C., space, in cities, suburbs and small cities throughout the nation.

And regardless of what many People have heard, greater than 97 p.c of I.R.S. staff don’t carry a gun. The few who do are legislation enforcement officers working to disrupt drug sellers, human traffickers and terrorists. For a overwhelming majority who don’t, essentially the most harmful factor on their particular person might be a calculator.

Like every bureaucratic establishment, the I.R.S. might actually enhance its effectivity and effectiveness. As commissioners, every of us, throughout varied presidential administrations, labored towards this aim. All of us sought to ship the service taxpayers deserve and to cut back the hole between taxes owed and taxes paid. And all of us sought to take action whereas adhering carefully to the Taxpayer Invoice of Rights, together with the suitable to privateness and the suitable to immediate, courteous, skilled help. None of us claimed to have had all the suitable solutions, so a contemporary perspective ought to all the time be welcome. And having served beneath each Republican and Democratic administrations and Congresses, we acknowledge and respect that elections have penalties.

However regardless of the future measurement and priorities of the I.R.S., our nation wants a totally functioning tax system.

Practically 200 million People are within the technique of finishing their tax returns. We urge warning in initiating main adjustments to I.R.S. operations throughout the submitting season. However even after submitting season ends, we consider — and we consider that profitable chief executives throughout the nation would concur — that making drastic cuts to accounts receivable as a means to enhance value effectivity simply doesn’t add up.

Lawrence Gibbs was an I.R.S. commissioner appointed by Ronald Reagan; Fred Goldberg, by George H.W. Bush; Charles Rossotti, by Invoice Clinton; Mark Everson, by George W. Bush; John Koskinen, by Barack Obama; Charles Rettig, by Donald Trump; and Daniel Werfel, by Joe Biden.

The Occasions is dedicated to publishing a diversity of letters to the editor. We’d like to listen to what you consider this or any of our articles. Listed below are some tips. And right here’s our e mail: letters@nytimes.com.

Observe the New York Occasions Opinion part on Facebook, Instagram, TikTok, Bluesky, WhatsApp and Threads.